- This Mac-first app looks and feels natural for Mac computers rather than just putting a Windows program in a Mac wrapper. Banktivity is easy to navigate, and you can quickly find what you need. Or you can set up workspaces (pages) to see exactly what you want when you want it.

- This list outlines the best free personal finance software for managing money on your Mac or PC, with links to free downloads and software reviews. This list outlines the best free personal finance software for managing money on your Mac or PC, with links to free downloads and software reviews. And almost all have mobile apps that are.

- Free Bookkeeping Software For Mac Australia

- Free Bookkeeping Software For Mac Reviews

- Free Bookkeeping App For Mac

- Free Bookkeeping Software Mac Os X

- Free Bookkeeping App For Android

As a free personal finance app and your own financial manager, Personal Capital is designed to be used across all platforms and is considered the best free personal finance software for all devices and platforms.

Keep Your Business Running With an Online Accounting Service

According the US Bureau of Labor Statistics, about 20 percent of small businesses fail before they complete their second year. Among the many potential culprits for this widespread demise is the lack of effective money management and bookkeeping. Small business accounting software can do a lot to prevent your business from falling into this trap, keeping you on the right side of that grim statistic.

Free Bookkeeping Software For Mac Australia

Financial bookkeeping is complicated and time-consuming. Business owners find it challenging enough to cover the basics—paying the bills and tracking incoming revenue—let alone answer critical questions such as these: Are we profitable? Why or why not? Can we make required tax payments? Should we invest in new equipment? Do we need to explore financing? Will we hit our budget numbers? Where can we cut expenses?

A good small business accounting website can answer these questions in seconds, based on the input you provide. Once you've populated a site with information about your financial accounts, your customers and vendors, and the products or services you sell, you'll be able to use that data to create transactions. These feed into reports, which can provide critical insight. Instant search tools and customizable reports help you track down the smallest details and see overviews of how your business is performing. Android apps and iOS apps for the services give you access to your finances anywhere that you have wireless connectivity.

QuickBooks Online's advanced implementation of technology, its skillful blend of features, its customizability, excellent mobile apps, and user experience have made it our Editors' Choice again this year. We're not crazy about the recent price increase, but Intuit services are often heavily discounted.

Setting Up Bookkeeping

Depending on how long your business has been operating, getting started with an accounting website can take anywhere from five minutes to several hours after signing up for an account. Accounting services charge monthly subscription fees and usually offer free trial periods. The more you need the site to do, the longer your setup tasks will take (and the higher the monthly payment).

First, you'll need to supply your contact details. If you want your logo to appear on sales and purchase forms, you can upload a file containing it. Some accounting service sites ask whether you plan to use specific features like purchase orders and inventory tracking, so they can turn them on or off. You may also be asked when your fiscal year starts, for example, and whether you use account numbers.

Do you want access to the transactions you have stored in online financial accounts (checking, credit cards, and so on)? Enter the user name and password you use to log on, and the accounting site will import recent transactions (usually 90 days' worth) and add them to an online register. Would you like to let customers pay with credit cards and bank withdrawals? You'll need to sign up with a payment processor like Stripe or PayPal (extra charges will apply).

Your People and Your Stuff

One of the really great things about using an accounting website is that it reduces repetitive data entry. Once you fill in the blanks to create a customer record, for example, you'll never have to look up that ZIP code again. When you need to use a customer in a transaction, it'll appear in a list. The same goes for vendors, items or services, and employees. No more card files or messy spreadsheets.

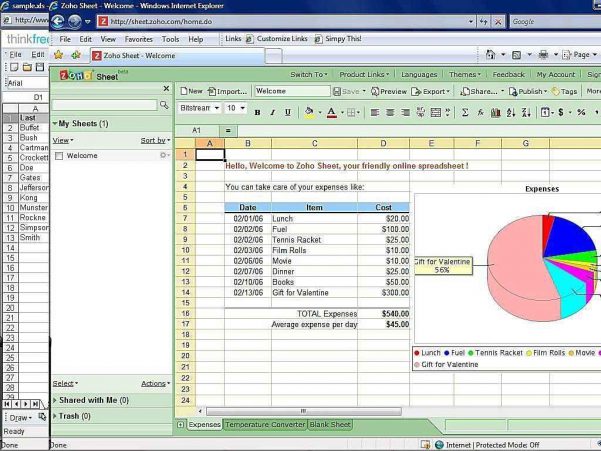

Once you've completed a customer record and started creating invoices, sending statements, and recording billable expenses, all of those actions will appear in a history within the record itself. Some sites, like Zoho Books, display a map of the individual or company's location and let you create your own fields so you can track additional information that's important to you (customer since, birthday, and other things like that).

If you have employees that you've been paying using another method, payroll setup can take some time and effort, since you'll have to enter payroll history information. Even when you're starting fresh with employee compensation, there's a lot of ground to cover. The site needs very precise details about things like your payroll tax requirements, benefits provided, and pay cycles. Many accounting solutions offer personal assistance with this task, and they all make it clear exactly what needs to be done before you run your first payroll. (Note, however, that some of the products here don't offer payroll capability.)

It is possible to do minimal setup and then jump into creating invoices, paying bills, and accepting payments. All of the services included here let you add customers, vendors, and products as you're in the process of completing transactions (you'll need to do so anyway as you grow and add to your contact and inventory databases). You just have to decide whether you want to spend the time up front building your records or take time out when you're in the middle of sales or purchase forms.

Most small business accounting sites offer the option to import existing lists in formats like CSV and XLS. They provide mapping tools to make sure everything comes in correctly. This procedure works better in some products than others.

Moving Money and Products

Accountants like to use phrases like accounts receivable and accounts payable to describe the primary elements of accounting: recording and tracking income and expenses, or sales and purchases. Small business solutions are designed to appeal to people who don't use the same kind of language as accounting professionals, avoiding such terminology.

The services let you easily create any transaction that a small business is likely to need. The most common of these are invoices and bills, and all the services we reviewed support them. Applications like Xero and Zoho Books go further, allowing you to produce more-advanced forms, such as purchase orders, sales receipts, credit notes, and statements. They provide templates for these online forms that resemble their paper counterparts. All you have to do is fill in the blanks and select from lists of customers and items.

Once you've completed an invoice, for example, you have several options. You can save it as a draft or a final version and either print it or email it. If you do the latter and you've established a relationship with a payment processor, your invoice can contain a stub explaining how the customer can return payment via credit card or bank withdrawal. You can create a PDF version of the invoice, copy it, record a payment on it, or set it up to recur on a regular schedule.

All forms on these sites work similarly. These solutions also pay special attention to your company's expenses—not bills that you enter and pay, but other purchases you make. This is an area of your finances that can easily get out of control if it's not monitored. So accounting websites monitor them, divide them into expense types, and compare them with your income using totals and colorful charts.

If you're traveling and have numerous related expenses on the road, for example, you can take pictures of receipts with your smartphone. Some sites just attach these receipts to a manually entered expense form. Others, like QuickBooks Online, actually 'read' the receipts and transfer some of their data (date, vendor, amount) to an expense form.

As we mentioned earlier, one of your setup tasks involves creating records that contain information about the products and services you sell so you can use them in transactions. These vary in complexity, so you need to understand the differences before you go with one site or another. Some, like Kashoo, simply allow you to maintain descriptive records. Others, like QuickBooks Online, go further. They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder. Then they actually track inventory levels, which provides insight on selling patterns and keeps you from running low.

Banking and Reports

While much of your daily accounting work probably involves paying bills, sending invoices, and recording payments, you also need to keep a close eye on your bank and credit card activity. If you've connected your financial accounts to your accounting service, this is easy to accomplish. For one thing, their balances will often appear on the site's dashboard, or home page. You'll also be able to view each account's online register, which contains transactions that have cleared your bank and been imported into your accounting solution (along with those you've entered manually).

You can do a lot with these transactions once they appear in a register. For one thing, they should be categorized (office expense, payroll taxes, travel and meal costs are some examples) so you know where your money is coming from and where it's going. Every service guesses at how at least some transactions might be categorized; you can change these if they're incorrect and add your own. Conscientious categorization will result in more accurate reports and income tax returns.

You can also match related transactions, such as an invoice that was entered in the system and a corresponding payment that came through. Again, some sites make educated guesses here. You can split transactions that should be assigned to multiple categories, make notes, and reconcile your accounts with your bank and credit card statements.

Read It in a Report

Reports are your reward for keeping up with your daily work and completing it correctly. Every accounting website comes with templates for numerous types of insightful output. You select one, customize it using the filter and display options provided, and let the site pour your own company data into it. It only takes a few seconds to generate a report after you've defined it.

There are really two types of reports. The bulk of them are the type that any small businessperson could customize, generate, and understand. They tell you who owes you money, which of your products and services are selling well, whether you're making money, which expenses and services haven't yet been billed, which customers are buying the most, how much you owe in sales tax, and more.

There are other reports, though, that aren't so easy to view and understand. These are considered standard financial reports, and they're the kind of documents you'll need if you ever want to get a loan from a bank or attract investors. They have names like Balance Sheet, Statement of Cash Flows, Trial Balance, and Profit & Loss. Accounting websites can generate them, but you really need an accounting professional to analyze them and tell you in concrete terms what they mean for you company.

How Accounting Sites Work

Accounting probably doesn't make the list of things you like to do as a business owner. It can be complicated, and it needs to be done correctly. So, the makers of online accounting solutions have worked hard to present this discipline as simply and, well, pleasantly as possible. Some—including QuickBooks Online, Zoho Books, and ZipBooks—have been more successful at this than others.

If you've ever used a productivity application online, you shouldn't have any trouble understanding these services' structure. They all divide their content into logical modules by providing toolbars and other navigation guides. Sales tasks are grouped together, as are purchase, inventory, reporting, and payroll activities. There's always a Settings link that takes you to screens where you can specify preferences for the entire site; these include your setup chores and settings you may need to modify at times, such as restricting additional users to specific areas.

A site's dashboard homepage provides a real-time overview of the financial information you need to see frequently, including charts comparing income and expenses, account balances, and invoices and bills that need immediate attention. There are often links to areas of the site where you can take action.

You use standard web conventions to navigate around each site and enter data. Along the way, you'll encounter lots of buttons and arrows, drop-down lists and menus. Color is sometimes used to signify related information, while graphics and fonts are well chosen to make the sites as aesthetically pleasing as possible.

Accounting Software for Simpler Businesses

If you're a sole proprietor or freelancer, you probably don't need all the features offered by full-featured small business accounting websites. You might want to track your online bank and credit card accounts, record income and expenses, maybe send invoices, and track time worked (if you're service-based). Maybe you need to track mileage. You might need help estimating your quarterly income tax obligation, and you certainly want mobile access to your financial data.

There are numerous sites that can do a combination of these things. They're easy to use, inexpensive (totally free in the case of Wave), and they overwhelm you with functionality you don't need.

Our Editors' Choice this year in this category goes to FreshBooks. This beautifully designed website started life as a simple online invoicing application, and it's since added more tools, including basic time- and project-tracking, expense management, estimate and proposal creation, and reports.

FreshBooks lacks some features that others offer, though. It doesn't help with quarterly estimated taxes, while GoDaddy Bookkeeping and QuickBooks Self-Employed do. It doesn't have its own integrated payroll-processing application like Wave does (though it integrates with payroll Editors' Choice Gusto and dozens of other related web services), and it's not a true double-entry accounting like Billy is. Wave also lacks QuickBooks Self-Employed's real-time mileage tracker and it doesn't automate as many processes as Less Accounting.

Note that while we did review Less Accounging, it didn't make the cutoff for this roundup of the top ten services. The same is true of Sage Business Cloud Accounting and ZipBooks.

The Accounting Software Your Business Needs

Whether you need one of these entry-level financial management websites or your business is complex enough that you need to start with one of the small business accounting options, we think you'll find that this year's batch of solutions offers enough variety that you can find the right fit for your business.

While you're thinking about your money, you might also like to consider our reviews of online payroll services and tax software.

Best Small Business Accounting Services Featured in This Roundup:

Intuit QuickBooks Online Review

MSRP: $50.00

Pros: Excellent user interface and navigation. Flexible contact records and transaction forms. Customizable reports. Comprehensive payroll support. Hundreds of add-ons and integrations. New project-management support.

Cons: Expensive. Poor online documentation.

Bottom Line: QuickBooks is the best online accounting application for small businesses, thanks to its depth, flexibility, and extensibility. It's easy to use, well designed, and built to serve a wide variety of users, but it's also pricey.

Read ReviewFreshBooks Review

MSRP: $15.00

Pros: Freshbooks offers a delightful user experience that enable freelancers and SMBs to quickly invoice customers and get paid faster. Team collaboration tools, time tracking, and estimate functionality are great add ons.

Cons: Poor reporting functionality, limited features in the estimates tool. Late Fees feature could use more options.

Bottom Line: FreshBooks offers a well-rounded and intuitive time tracking, online accounting, and invoicing solution that anticipates the needs of freelancers and small businesses.

Read ReviewZoho Books Review

MSRP: $19.00

Pros: Affordable. Excellent user interface. Superior depth in records and transaction forms, including numerous custom fields. Multiple payment gateways. Good project- and time-tracking. Document management. Generous support options. Excellent mobile version.

Cons: Integrated payroll feature limited to California and Texas.

Bottom Line: Zoho Books is an excellent choice for cloud-based small business accounting, with an excellent interface, an attractive price, and a rich set of tools. Its limited payroll offering may cause some users to look elsewhere, however.

Read ReviewIntuit QuickBooks Self-Employed Review

MSRP: $10.00

Pros: Exceptional user interface and navigation. Easily tracks expenses and income. Automatic mileage tracking. Can assign business transactions to Schedule C categories. Estimates quarterly income taxes. OCR capability.

Cons: Lacks direct integration with e-commerce sites. No data records, time tracking, project tracking, or recurring transactions. Invoices not customizable or thorough. No estimates or sales tax.

Bottom Line: The simplicity of online accounting service QuickBooks Self-Employed may make it a good fit for some freelancers and independent contractors, but others will miss standard features like time tracking, project tracking, and estimates.

Read ReviewBilly Review

MSRP: $15.00

Pros: Excellent user experience and dashboard. Double-entry accounting. Easy to establish different sales taxes. Supports both quotes and estimates.

Cons: Some operations involve dealing with debits and credits. No timer or dedicated time-tracking. Few reports. No full mobile app. Only one third-party add-on.

Bottom Line: Billy's combination of tools and usability make it a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It doesn't offer a lot of reports or third-party add-ons, however.

Read ReviewGoDaddy Bookkeeping Review

MSRP: $3.99

Pros: Inexpensive. Good invoicing tools and overview. Simple time tracking. Calculates estimates for quarterly taxes. Direct integration with PayPal, Amazon, eBay, and Etsy.

Cons: No project tracking or bill payment. No individual logins for other users. Lacks multi-currency support. Minimal client information in records. No auto-categorization.

Bottom Line: GoDaddy Bookkeeping's direct integration with Amazon, eBay, and Etsy make it a terrific tool for entrepreneurs who sell at those sites, but its overall bookkeeping depth and flexibility doesn't match FreshBook's.

Read ReviewXero Review

MSRP: $30.00

Pros: Affordable. Thorough record and transaction forms. Approval levels. Inventory tracking. Customizable reports. Online quotes. Smart Lists. Updated expense tracking. Exceptional online support.

Cons: Payroll not available for all states. Time tracking still in beta. Lacks phone and chat help. Weak mobile apps.

Bottom Line: Double-entry accounting app Xero excels at inventory management, payroll, and many other functions critical to keeping the books of a small business.

Read ReviewWave Review

MSRP: $19.00

Pros: Free, though payments and payroll incur fees. Smart selection of features for very small businesses. Excellent invoice- and transaction-management. Good user interface and navigation tools. Multicurrency. Payroll.

Cons: No dedicated project- or time-tracking features. No comprehensive mobile app.

Bottom Line: Wave is priced like a freelancer accounting application (it's free) and it's an excellent service for that market, but it also offers enough extras that a small business with employees could use it-with some caveats.

Read ReviewKashoo Review

MSRP: $19.99

Pros: Simple, clean user interface. Good income and expense management. Project cost-tracking. Free email, phone, and chat support. Integrates with SurePayroll.

Cons: Doesn't use a standard dashboard. Lacks time and inventory tracking. No Android app. Few add-ons.

Bottom Line: Online accounting service Kashoo's strengths are income and expense management, usability, and support. It's a simple, speedy choice for smaller businesses that don't need product inventory tracking or robust time billing tools.

Read ReviewWorkingPoint Review

MSRP: $9.00

Pros: Customizable dashboard. Good user experience. Capable inventory tracking. Estimates quarterly taxes. Schedule C report. Includes simple company website.

Cons: No mobile version. Recurring invoices are dispatched without review. Inflexible user permissions. Few add-ons. No built-in payroll or integration with payroll services.

Bottom Line: WorkingPoint is an easy-to-use double-entry accounting service with unique features like quarterly estimated tax calculation and a mini site builder, but it has no mobile version or payroll feature.

Read Review

Best Small Business Accounting Services Featured in This Roundup:

Intuit QuickBooks Online Review

MSRP: $50.00Pros: Excellent user interface and navigation. Flexible contact records and transaction forms. Customizable reports. Comprehensive payroll support. Hundreds of add-ons and integrations. New project-management support.

Cons: Expensive. Poor online documentation.

Bottom Line: QuickBooks is the best online accounting application for small businesses, thanks to its depth, flexibility, and extensibility. It's easy to use, well designed, and built to serve a wide variety of users, but it's also pricey.

Read ReviewFreshBooks Review

MSRP: $15.00Pros: Freshbooks offers a delightful user experience that enable freelancers and SMBs to quickly invoice customers and get paid faster. Team collaboration tools, time tracking, and estimate functionality are great add ons.

Cons: Poor reporting functionality, limited features in the estimates tool. Late Fees feature could use more options.

Bottom Line: FreshBooks offers a well-rounded and intuitive time tracking, online accounting, and invoicing solution that anticipates the needs of freelancers and small businesses.

Read ReviewZoho Books Review

MSRP: $19.00Pros: Affordable. Excellent user interface. Superior depth in records and transaction forms, including numerous custom fields. Multiple payment gateways. Good project- and time-tracking. Document management. Generous support options. Excellent mobile version.

Cons: Integrated payroll feature limited to California and Texas.

Bottom Line: Zoho Books is an excellent choice for cloud-based small business accounting, with an excellent interface, an attractive price, and a rich set of tools. Its limited payroll offering may cause some users to look elsewhere, however.

Read ReviewIntuit QuickBooks Self-Employed Review

MSRP: $10.00Pros: Exceptional user interface and navigation. Easily tracks expenses and income. Automatic mileage tracking. Can assign business transactions to Schedule C categories. Estimates quarterly income taxes. OCR capability.

Cons: Lacks direct integration with e-commerce sites. No data records, time tracking, project tracking, or recurring transactions. Invoices not customizable or thorough. No estimates or sales tax.

Bottom Line: The simplicity of online accounting service QuickBooks Self-Employed may make it a good fit for some freelancers and independent contractors, but others will miss standard features like time tracking, project tracking, and estimates.

Read ReviewBilly Review

MSRP: $15.00Pros: Excellent user experience and dashboard. Double-entry accounting. Easy to establish different sales taxes. Supports both quotes and estimates.

Cons: Some operations involve dealing with debits and credits. No timer or dedicated time-tracking. Few reports. No full mobile app. Only one third-party add-on.

Bottom Line: Billy's combination of tools and usability make it a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It doesn't offer a lot of reports or third-party add-ons, however.

Read ReviewGoDaddy Bookkeeping Review

MSRP: $3.99Pros: Inexpensive. Good invoicing tools and overview. Simple time tracking. Calculates estimates for quarterly taxes. Direct integration with PayPal, Amazon, eBay, and Etsy.

Cons: No project tracking or bill payment. No individual logins for other users. Lacks multi-currency support. Minimal client information in records. No auto-categorization.

Bottom Line: GoDaddy Bookkeeping's direct integration with Amazon, eBay, and Etsy make it a terrific tool for entrepreneurs who sell at those sites, but its overall bookkeeping depth and flexibility doesn't match FreshBook's.

Read ReviewXero Review

MSRP: $30.00Pros: Affordable. Thorough record and transaction forms. Approval levels. Inventory tracking. Customizable reports. Online quotes. Smart Lists. Updated expense tracking. Exceptional online support.

Cons: Payroll not available for all states. Time tracking still in beta. Lacks phone and chat help. Weak mobile apps.

Bottom Line: Double-entry accounting app Xero excels at inventory management, payroll, and many other functions critical to keeping the books of a small business.

Read ReviewWave Review

MSRP: $19.00Pros: Free, though payments and payroll incur fees. Smart selection of features for very small businesses. Excellent invoice- and transaction-management. Good user interface and navigation tools. Multicurrency. Payroll.

Cons: No dedicated project- or time-tracking features. No comprehensive mobile app.

Bottom Line: Wave is priced like a freelancer accounting application (it's free) and it's an excellent service for that market, but it also offers enough extras that a small business with employees could use it-with some caveats.

Read ReviewKashoo Review

MSRP: $19.99Pros: Simple, clean user interface. Good income and expense management. Project cost-tracking. Free email, phone, and chat support. Integrates with SurePayroll.

Cons: Doesn't use a standard dashboard. Lacks time and inventory tracking. No Android app. Few add-ons.

Bottom Line: Online accounting service Kashoo's strengths are income and expense management, usability, and support. It's a simple, speedy choice for smaller businesses that don't need product inventory tracking or robust time billing tools.

Read ReviewWorkingPoint Review

MSRP: $9.00Pros: Customizable dashboard. Good user experience. Capable inventory tracking. Estimates quarterly taxes. Schedule C report. Includes simple company website.

Cons: No mobile version. Recurring invoices are dispatched without review. Inflexible user permissions. Few add-ons. No built-in payroll or integration with payroll services.

Bottom Line: WorkingPoint is an easy-to-use double-entry accounting service with unique features like quarterly estimated tax calculation and a mini site builder, but it has no mobile version or payroll feature.

Read Review

Today's Best Tech Deals

Picked by Macworld's Editors

Top Deals On Great Products

Picked by Techconnect's Editors

Intuit QuickBooks for Mac 2014

Read Macworld's reviewCognito Software MoneyWorks Gold 7 (Mac)

Acclivity AccountEdge Pro 2014

Marketcircle Billings Pro 1.6

If home is where your heart is, then there’s a pretty good chance that home—or at least your Home Folder—is where you prefer to keep your business’ financial information. While there are plenty of excellent Web-based apps you can use for tracking your business finances, if you’re uncomfortable with the idea of working within a browser and keeping your business’ financial information in the cloud, a traditional Mac application is your best option.

I looked at four apps for managing your business invoicing and finances: Cognito Software’s MoneyWorks Gold, The Acclivity Group’s AccountEdge Pro, Intuit’s QuickBooks for Mac, and Marketcircle’s Billings Pro. The first three are traditional invoicing and accounting applications, while Billings Pro offers compelling features, but also requires additional software to complete the package. Though all of these apps offer excellent tools for managing your business finances, MoneyWorks Gold stands above the rest, for an excellent user interface.

Top choice: MoneyWorks Gold 7

If you’ve been around the Mac accounting game for any length of time you’re likely already aware of the more well-known players, QuickBooks and AccountEdge. The one application that probably hasn’t made it onto your radar—but should have—is Cognito Software’s MoneyWorks Gold (; $499). MoneyWorks Gold is a solid, full-featured business accounting application that is networkable, supports multiple users, and works on both Macs and PCs.

MoneyWorks uses a flowchart-like interface similar to what’s used by both AccountEdge and QuickBooks for Mac. The application’s interface consists of a sidebar with navigation links to MoneyWorks’ collection of financial tools and a larger main window that displays a flowchart that changes depending on which item you’ve selected in the sidebar. As is the case with both AccountEdge and QuickBooks 2014, the flowchart attempts to create a visual relationship between various business activities. While this makes all of these applications a bit more interesting visually, in practice I’ve rarely used the flowchart to figure out how the many aspects of a business are related.

Most of the tools you’ll use on a regular basis appear in the navigation section entitled Day-to-day. Here you can create quotes, sales orders, and invoices, reconcile your bank accounts, create and receive purchase order items, and review accounts payable. Each of these same tasks are also available in other areas of the application and selecting other Navigation options provides you with access to a deeper set of tools and features. For example, when you select Items and Inventory you have tools for receiving stock on items you’ve ordered, viewing a journal list of all the stock you have on hand, and building new stock items from items you have in your existing inventory.

MoneyWorks includes just under 100 reports, including sales tax reports for Canada and VAT reports for the U.K. If none of the application's existing reports fit your specific needs, you can create custom reports of your own. Reports are available either from the Reports menu or from the main application window when you’ve selected a specific navigation area. For example, selecting Chart of Accounts from the navigation sidebar provides you with links for a number of account-related reports.

Two features make MoneyWorks a standout: Multiuser network capabilities and cross-platform client applications. (Features also found in Acclivity’s AccountEdge product.) Sharing your MoneyWorks file on the network is as simple as opening the Sharing and Users settings and putting a check in a box to turn on sharing. (A Datacenter version allows access by iOS devices and multicompany hosting) By default the application allows access to anyone on the network, so to limit access you also need to password protect your data file. Once you do so you can add users and limit their access to features. Unfortunately, there is no group option for managing user access to data, so every user you create needs to have access managed individually.

Top contender: AccountEdge Pro

Depending on how you look at Acclivity’s AccountEdge Pro (; $399 new, $159 single user upgrade, $249 multiuser upgrade) it is either a little stale or as consistent as it has ever been. The basic idea behind the application’s flowchart interface has been around since it was first released well before Mac operating systems were named after cats. Little has changed about the way the AccountEdge looks in nearly a dozen years, but, in terms of accounting capabilities, it remains a solid application.

Free Bookkeeping Software For Mac Reviews

AccountEdge has long been an application that allowed you to do your business in a networked environment on both Macs and PCs and, like MoneyWorks, gives you control over who has access to specific parts of your company’s financial data. The program still provides excellent tools for securing your data while still providing access to your accounting and inventory data in a multiuser, multiplatform environment.

While not much has changed on the front end, AccountEdge has added a few new features for 2014, including the addition of master inventory items that allow you to create dozens of varieties with out having to create distinct inventory items for each variety. So, for example, you can create a category called Whole Bean Coffee that can then be broken down into more specific varieties such as specific roasts in caffeinated or decaf, all of which makes it much easier to manage your inventory. Acclivity has also rebranded and updated its AccountEdge Web front end, offering features in the cloud, including options for creating invoices and other transactions from a webpage.

The rest of the pack

Billings Pro 1.6.5

Marketcircle’s Billings Pro (; $0/$5/$10 per month per user plans, or $99 per year per user) is beautifully-designed application that uses a subscription-based service with some Web-based features, but with which you create invoices, estimates, and collect time-billing information using your Mac OS or iOS device. Everything you do is created and managed locally and then synced with using a database that is hosted on Marketcircle’s servers.

I’ve used the Mac and iOS versions of the original Billings application for years and, like many, was disappointed when Marketcircle dropped the standalone application in favor of a client-server subscription model. That said, after about a month of using Billings Pro instead of the standalone application, I found it to be better than the old standalone version.

Billings Pro is not an accounting application, but you can export Billings Pro data directly into QuickBooks for Mac or MoneyWorks 6. (At present, MoneyWorks 7 is not supported, but Marketcircle states that support is forthcoming.) What makes Billings a standout is integrated time billing and what are probably the most beautiful, customizable documents you will ever see in a program of this type. The key here, though, is time billing. While almost every business accounting package you’ll find offers a way to enter time billing information into time sheets, Billings Pro lets you track your time in the field, and create an invoice directly from the collected information. This may sound like a small deal, but it’s integral to the way many people bill for services, and a feature missing from all of the other applications mentioned here.

While I do love Billings Pro, it’s not perfect and requires you to discover the “Billings Pro workflow” before you can use it. In the Billings Pro world everything you do needs to be part of a project, so no matter what you’re doing, you have to set up a project first and then add Working Slips to those projects and bill based on information collected in the slip. This isn’t a huge problem, but may be an unnecessary step for some businesses.

QuickBooks Mac 2014

QuickBooks Mac 2014 got a full review in Macworld (; $250) last December... well, no surprise, there haven’t been any changes.

While this business accounting application has made it easier to get your data to and back from your accountant, it is still incapable of working in mixed Mac and PC environments. Sad, but true. But that doesn’t mean that it’s a poor accounting application. QuickBooks for Mac will take good care of your business finances, as long as you understand its limitations.

A new user interface gives QuickBooks a look and feel similar to Intuit’s Mint.com and the new Web interface for QuickBooks Online. This new look gives you a great overview of your financial status at a glance. While not everything you might want, QuickBooks for Mac 2014 still gives you what you need to take care of business.

Free Bookkeeping App For Mac

Bottom line

Color me surprised. While AccountEdge remains an excellent application for managing your business finances, and remains one of my personal favorites, MoneyWorks Gold offers all the accounting features you’ll need, though it is more expensive than AccountEdge. And while it doesn’t offer any true accounting features, Billings Pro is the only invoicing application available that allows you to create invoices from time billing information you collect. For me, that’s a necessary feature missing from all of the other applications. QuickBooks, while good, still lags behind the others because it lacks the cross-platform capabilities necessary for any fully networked cross-platform business environment.

Free Bookkeeping Software Mac Os X

Editor's note: Updated on 4/10/14 to correct MoneyWorks Gold pricing.

Free Bookkeeping App For Android

Intuit QuickBooks for Mac 2014

Read Macworld's reviewCognito Software MoneyWorks Gold 7 (Mac)

Acclivity AccountEdge Pro 2014

Marketcircle Billings Pro 1.6